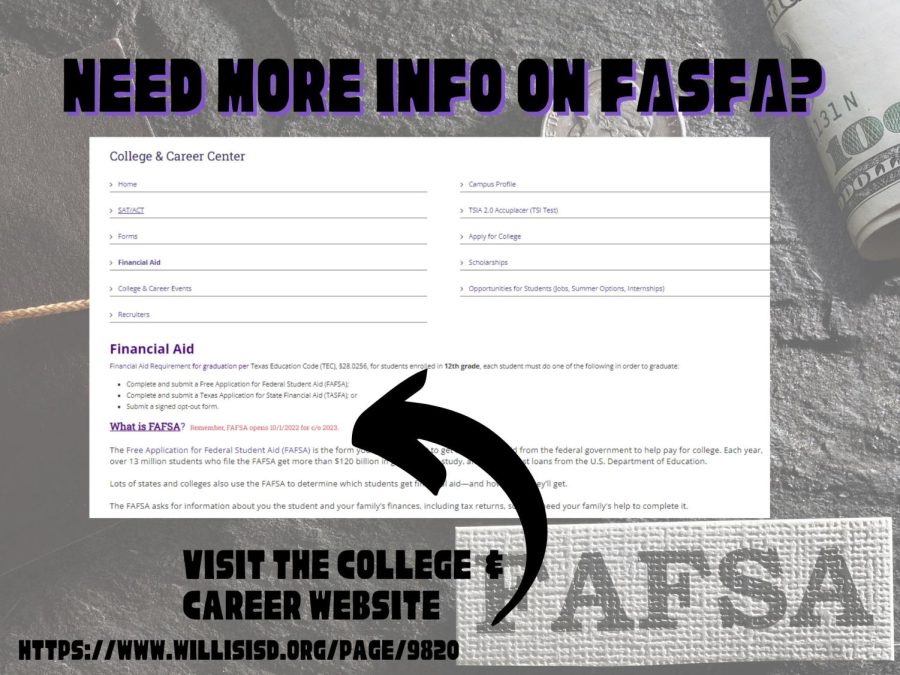

Time to FAFSA for class of 2023

photo or infographic by Michael Scholwinski

ARE YOU READY TO FASFA? The FASFA application opened on Oct. 1 for the class of 2023.

The FAFSA for all seniors can look both promising and scary when it starts on October 1st. The long document when first looked at can be seen as a long list of personal information that takes around an hour to complete for some parts. It also can seem like a chore due to the FAFSA being a requirement for graduation within the state of Texas, it can seem almost forced to complete the long lists of forms just to walk across the stage.

Completing the FAFSA is actually easier than it can first appear through following easy steps and taking you time with the material.

Getting into the site through the government site, https://studentaid.gov/, is the best way to start. Making an account with the student aid site and then starting a new form through the site will be a first step in completing the FAFSA. After starting your account, you should also have a parent start an account to complete their part of the process as well. Starting this with your parents is critical, due to the need for taxes from your parents and other social security information. While working with your parents there are some required documents that you and your parents are going to need on hand such as Drivers Licenses’, Social Security cards, and Tax Information. Getting these Documents together, you can now easily start and finish the first FAFSA form with ease. Another part of the process after completing personal information is to decide what schools to ask for funding from, which should be carefully chosen by you and then put onto the FAFSA form.

After completing the FAFSA form, it’s important to start thinking about scholarships and waiting to get offers from schools that you apply to. It’s also important to start thinking about student loans and how you will start paying off the rest of your debt to your preferred college. This can be at first a hard process, but with careful consideration and using effective scholarship money, paying off college without loans can be accessible to many students. Many colleges are also offering through FAFSA to pay off either a portion or all of your tuition through special programs, so for students worried about paying off student loans these schools should be looked at. Many Ivy league colleges offer scholarships and heavy resources to pay off your full time at their college for almost free through the FAFSA or other programs. Many state colleges within Texas often offer scholarships or special programs through FAFSA that can help pay off your tuition if you’re within a certain monetary income. Through the FAFSA you are able to easily access these opportunities and get prepared to pay off your tuition and much more without having to worry about student loans.

Going into the College and Career Center with Mrs. Neumann is one easy way of getting a quick tutorial on the basics of FAFSA and helping through the forms with you. Using the College and Career Center site as well, https://www.willisisd.org/Page/9820, gives helpful links as well as helpful guides, FAQs, and videos on how to complete the FAFSA.

Your donation will support the student journalists of Willis High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Michael Scholwinski is a 1st year newspaper staff member who has been active in many aspects of school life. A previous football player and current wrestler,...